Buying a home is one of the most crucial decisions a person may perform in his life. This is typical because of the emotional attachment that is later assigned to the place. However, a home is also one of the largest investments a person may ever perform in his life. Therefore, it is important to familiarize yourself with the finances and contracts involved before buying a home.

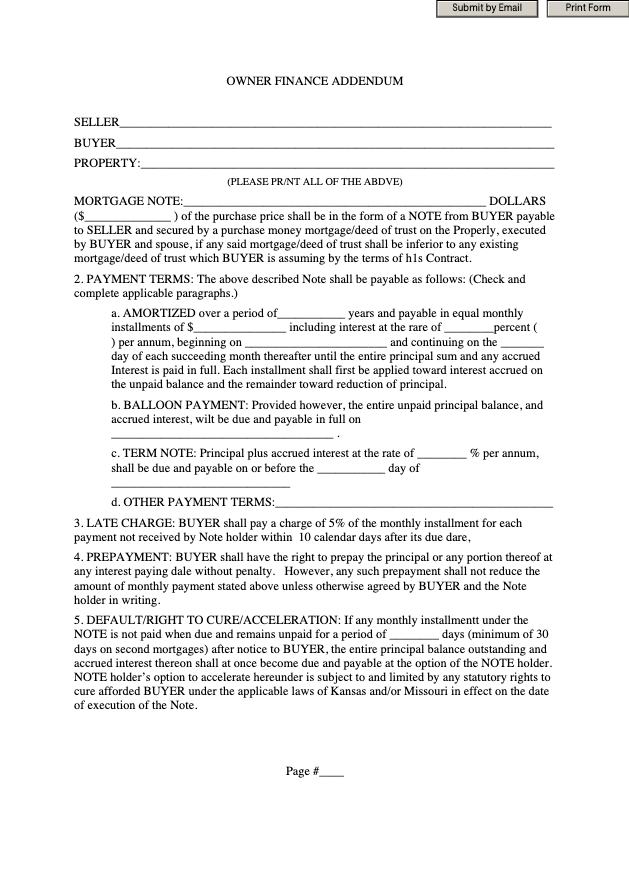

One such contract is the owner financing contract, which is a legally binding contract that is directly associated between the seller's party and the buying party.

What Is an Owner Financing Contract?

In the owner financing contract template, the finances of the home purchases are directly accompanied by the seller instead of involving a bank or traditional mortgage lender. This is why 'owner financing contract’ is also known as ‘seller financing contract.'

The interest rate that is provided by the homeowner is often higher than the home mortgage rates currently in the market. This is because there is also a balloon payment involved to save on the interest cost that is involved with the interest outflow. The duration for balloon payment is at least five years after due.

Perhaps you are a real estate investor, or you just want to buy a home for your personal needs. In either case, a seller financing contract template will serve to be a crucial contract to legally acquire properties and flip them.

With this contract, the seller of the home or real estate goes through a waiting period in order to acquire all of his sales prices. The seller carries back all of the sale price or part of it using the owner finance agreement.

What Are the Pros and Cons of Owner Financing?

There are several advantages and disadvantages associated with owner financing for both sellers and buyers. A few of them are briefed below:

Advantages for Buyers

- Access to Financing: Owner financing provides a borrower with access to financing for which he may not be qualified.

- Decreases Costs of Closing: The costs of closing are effectively reduced by eradicating bank fees, inspection costs, appraisal costs, etc.

Disadvantages for Buyers

- Higher Interest rate: The interest that a buyer has to pay in owner financing is oftentimes higher than the interest a bank provides.

- Balloon Payments: If the financing is not secured by the balloon payment period, which is typically five or ten years, then the buyer loses all of the invested money.

Advantages for Sellers

- Better Returns: The seller is provided with an investment opportunity that yields better returns as compared to conventional investments.

- Selling Process Shortened: The amount of time it takes in the real estate selling process is significantly shortened because of the lack of a lending process and other diligence requirements involved otherwise.

Disadvantages for Sellers

- Inflation: Inflation may occur, and when it does, the fixed payment seller investments would be decreased in their value.

- Trust issues: If the buyer is not a trusted person, the payments of the property would not be made in a timely manner, and the property rate may deteriorate.

What Is Included in an Owner Financing Contract?

There are different owner financing contracts, and some of them may slightly vary with the clauses they include inside them. However, an owner contract agreement will typically include:

- Contact Details: The contact details of both the buying party and the selling party are enlisted in the owner finance contract. This includes the full name, contact number, and residential address.

- Property: The name of the property is also enlisted in the seller financing contract.

- Contract Amount: The full amount that the buyer has agreed upon to pay to the seller.

- Deposit: The deposit that the buyer has to pay to the seller as earnest money. This is enlisted along with the date on which the deposit shall be transferred to the seller.

- Interest Rate: The interest rate for the financed amount stated in terms of quarterly, monthly, or yearly plan.

- Separability Clause: In case any provision of this contract is found invalid or illegal, the legality or validity of the remaining parts shall not be in any way affected.

- Financing: The remaining balance that was financed by the seller to be paid by the buyer.

Conclusion

Owner financing contract is a powerful contract for investors today to utilize for their real estate properties. The owner financing that is bound within the contract allows the sellers to shorten the selling process and also get better returns. All the agreements involved are clearly stated in the contract for both the buying and the selling parties.